Imf Diversity Report

diversity report wallpaperIn this report Bankes discusses the change drivers that led to the decision to insource a large portion of the work performed by a number of. Indeed gender diversity brings benefits all its own.

5 The Imf S Income Model Imf Financial Operations 2018

5 The Imf S Income Model Imf Financial Operations 2018

IMF Diversity and Inclusion Annual Report.

Imf diversity report. The Case for Insourcing is a report based on an IMF presentation given at a 2014 IMF Senior Executive Forum by Marks Work Wearhouse and FGL Sports Vice President of Information Technology Rick Bankes. More information and data on ongoing efforts to improve diversity and inclusion at the IMF are available in the 201617 IMF Diversity and Inclusion Annual Report. Kristalina Georgieva the IMFs managing director has urged governments to expand healthcare provision and welfare policies to protect.

Provide pecuniary incentive to the Paris agreement. For even more Women Matter research browse the full series. Equal rights and opportunities are frequently challenged.

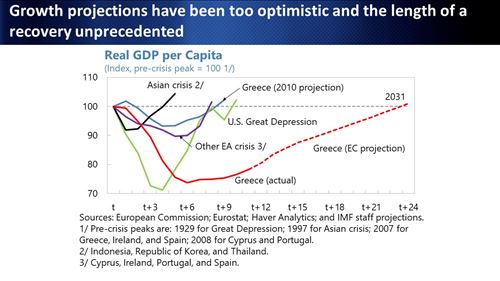

Women bring new skills to the workplace. To better appreciate this problem we need to understand what the IMF does. The International Monetary Fund IMF has projected that the global economy will grow 55 in 2021 a figure 03 percentage points higher than its forecast from October 2020.

The latest Fund research shows that improving gender diversity can result in larger economic gains than previously thought. 2003 was marked by three major accomplishments towards this end. Achieving a level of diversity that reflects all 183 member countries sets high demands on the institution.

Promoting gender diversity in the Gulf. Ensuring that diversity is integrated into our daily work means creating a culture and practices that recognize value and harness what makes every individual unique in the broader sense by acknowledging and respecting differences including nationality gender race religion ethnicity age sexual orientation disability and education background. The International Monetary Fund has warned that the COVID-19 pandemic has pushed international debt levels already at record highs in 2019 to heights that could trigger a crisis.

I hope that banks and others will pay heed to these recommendations and work to ensure their institutions are as inclusive and diverse as the customers and communities they serve. Diversity equality in business. Much headway was made in 2001 in improving mentoring and training opportunities.

FY 201620173 Statement on Diversity and Inclusion At the Fund our commitment to diversity and inclusion is crucial to fulfilling our mission. Staff diversity is a fundamental personnel principal at the IMF. While good progress is being made on these fronts this report also underscores how much more effort is needed to improve the Funds intellectual diversity.

The Funds commitment to transparency was further signaled by managements decision to post the 2001 Annual Diversity Report on the Funds external Web site. Taking the lead for inclusion. The International Monetary and Financial Committee IMFC has consistently drawn attention in its communiqués to the importance of enhancing the gender diversity of the Executive Board.

As an international organization we are committed to having a staff that reflects the diversity of our membership. While progress has been made in increasing female labor force participation FLFP in the last 20 years large gaps remain. Diversity is defined in this report in terms of gender and national origin.

Progress Report of the Executive Board to the Board of Governors November 23 2020 Executive Directors underscore the importance of promoting gender diversity at the IMFs Executive Board and the Offices of Executive Directors OEDs. The Funds membership has also indicated that it places importance on this issue. Time to accelerateTen years of insights into gender diversity the full report on which this article is based PDF16MB.

Impart carbon price guidance. In 2017 IMF attained the ASSESS level of EDGE Economic Dividends for Gender Equality certification in recognition of its commitment to progress in monitoring benchmarking and achieving workplace gender equality. Gender Diversity in the Executive Board.

This landmark report marks the first of several deep dives the Committee will take into the diversity practices of financial services industries. Gender diversity in top. FY 2014 DIVERSITY AND INCLUSION ANNUAL REPORT 1 INTERNATIONAL MONETARY FUND Diversity Inclusion Statement June 2012 At the Fund our commitment to diversity and inclusion is crucial to fulfilling our mission.

An IMF Climate Coin would offer several solutions to the steep challenges of today. FY 2013 DIVERSITY AND INCLUSION ANNUAL REPORT INTERNATIONAL MONETARY FUND 7 following the report of an internal Task Force on Diversity Benchmarks the Fund established a set of indicators or benchmarks to help guide central recruitment efforts. Introducing the Enhanced Diversity Action Plan establishing the Discrimination Policy and conducting the Staff Survey.

As an international organization we are committed to having a staff that reflects the diversity of our membership. A Fundwide mentoring program was developedto be piloted in 2002for mid-career newcomers. IMF Diversity Annual Report 2003 The goal of the Funds diversity efforts is to ensure strong institutional performance and an optimal use of individual and collective resources.