Imf Report Denmark

denmark report wallpaperThe countries involved are Denmark Estonia Finland Iceland Latvia Lithuania Norway and Sweden. Together with the Ministry of Finance Danmarks Nationalbank coordinates day-to-day aspects of Denmarks relations with the IMF via the Nordic-Baltic constituency which besides Denmark comprises Norway Sweden Finland Iceland Estonia Latvia and Lithuania.

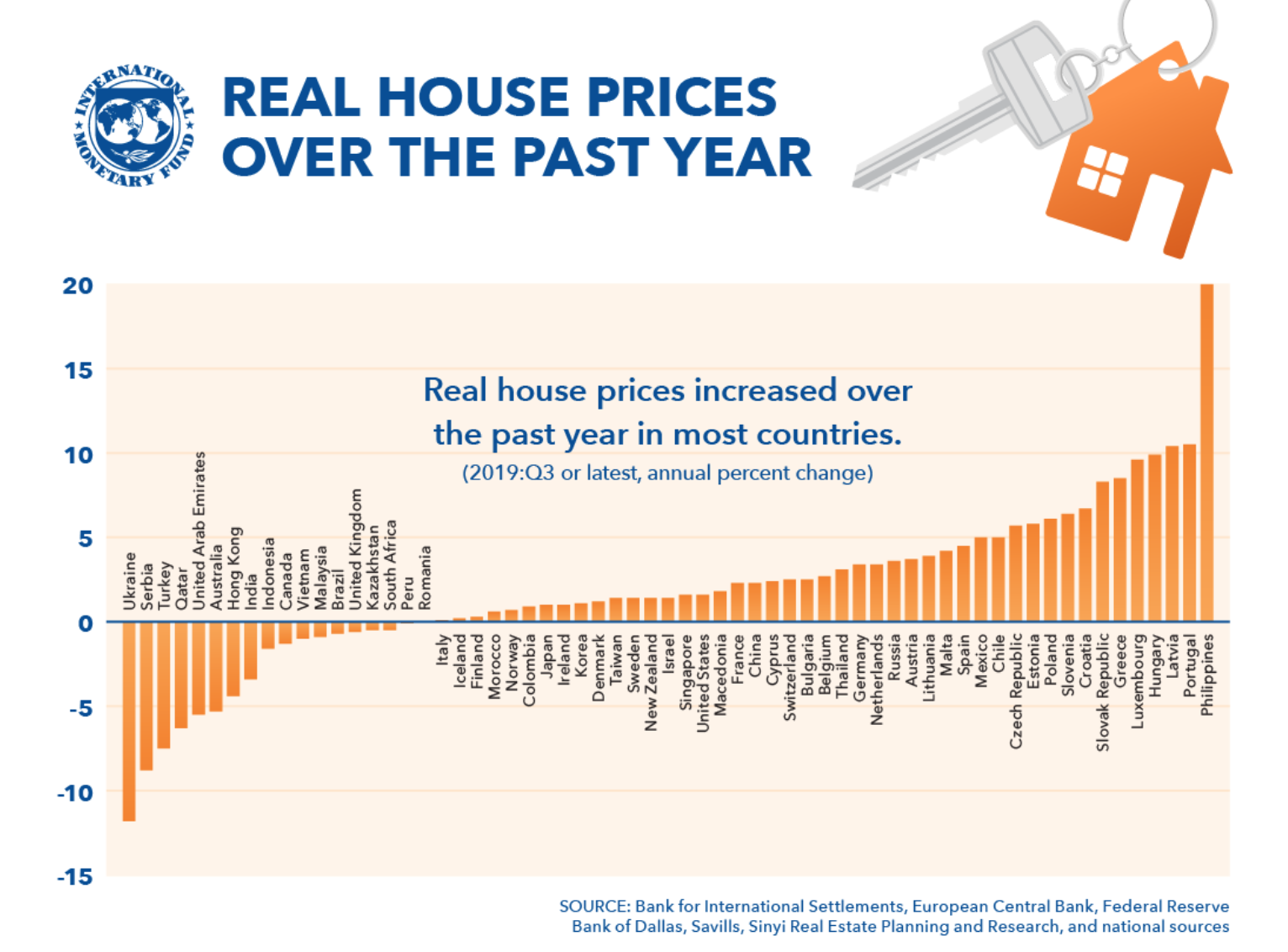

Imf House Prices Increase In Most Countries Around The World Cgtn

Imf House Prices Increase In Most Countries Around The World Cgtn

This report is based on the work of an IMF Financial Sector Assessment Program FSAP mission to Denmark during October 30November 14 2019 and February 25March 18 2020.

Imf report denmark. The key findings of Denmarks 2008 Article IV Consultation are examined. Listed below are items related to Denmark. The World Economic Outlook WEO database is created during the biannual WEO exercise which begins in January and June of each year and results in the April and SeptemberOctober WEO publication.

This 2014 Article IV Consultation highlights that the Danish economy is recovering slowly and unevenly. IMF Country Reports cover economic and financial developments and trends in member countries. The Nigerian authorities disagreed telling the IMF that a lower naira would stoke inflation.

Each report prepared by a staff team after discussions with officials of the country is published at the option of the member. This report is based on the work of the IMF Financial Sector Assessment Program FSAP mission to Denmark during June. The economy contracted slightly in 2013 but it looks likely to accelerate modestly in 2014.

The crisis accelerated a downturn that had begun in 2007 and tilted the balance of macroeconomic risk toward recession. The FSSA report was completed on June 29 2020. The IMF held discussions with the government and central bank before publishing a report this week in which it argues that the naira is overvalued by 18 and needs to be devalued.

The output gap has seemingly closed for the first time since the global financial crisis. This 2018 Article IV Consultation highlights continued solid growth in the Danish economy. 20254 DENMARK FINANCIAL SECTOR ASSESSMENT PROGRAM TECHNICAL NOTESYSTEMIC LIQUIDITY This Technical Note on Systemic Liquidity for the Denmark FSAP was prepared by a staff team of the International Monetary Fund as background documentation for the periodic.

Unemployment is low and close to its estimated structural level and capacity constraints are gradually starting to bind in some sectors. Country Report 2017 - Includes Denmark real Gross Domestic Product growth rate with latest forecasts and historical data GDP per capita GDP composition and breakdown by sector. Danmarks Nationalbank contributes to the IMFs crisis response and has made new lending resources available to the IMF on behalf of Denmark.

This is attributable mainly to the activation of macroprudential instruments improved supervision of banks and insurers and strengthened crisis management frameworks. The last Article IV Executive Board Consultation was on June 21 2019. In this report Bankes discusses the change drivers that led to the decision to insource a large portion of the work performed by a number of.

14336 DENMARK FINANCIAL SYSTEM STABILITY ASSESSMENT The Financial System Stability Assessment for Denmark was prepared by a staff team of the IMF for the Executive Boards consideration on December 5 2014. 2020 International Monetary Fund IMF Country Report No. This 2017 Article IV Consultation highlights the recovery of the Danish economy which is approaching potential despite growth in recent years that has been markedly slower than before the crisis.

Unemployment is low and close to its estimated structural level with signs of labor shortages and capacity constraints in some sectors. Property prices in urban areas are rising swiftly. DENMARK INTERNATIONAL MONETARY FUND.

In its report the IMF finds that the resilience of the Danish financial sys-tem has been strengthened since its most recent analysis from 2014. The metric currently used should compare tax gap losses identified by random audit programs to the total net rather than gross amounts of tax due. The authorities in eight Baltic and Nordic countries have asked the International Monetary Fund to analyse the money laundering and financing of terrorism risks they face.

The demand for IMF loans is expected to increase further as a result of the coronavirus crisis and vulnerabilities in a number of countries. The coincidence of low output growth and increasingly. At the same time private domestic demand and non-oil exports are supporting growth.

Browse additional economic indicators and data sets selected by Global Finance editors to learn more about Denmark. IMF Country Report No. The Case for Insourcing is a report based on an IMF presentation given at a 2014 IMF Senior Executive Forum by Marks Work Wearhouse and FGL Sports Vice President of Information Technology Rick Bankes.

Policy support is key to financial stability with IMFs Fabio Natalucci SDR Rates for February 11 2021 SDR Interest Rate 0090 1 USD SDR 069329 MORE The IMF and COVID-19. Nigerian inflation at 1575 in December was at its highest rate in three years driven by higher food prices. The global liquidity crisis put the financial sector under severe stress but most banks have weathered the crisis well owing to strong initial positions and supportive policies.

The IMF notes that the tax gap measure used by the Danish tax administration is flawed and has only partial coverage of the total tax gap. Growth is held down by a trend decline in North Sea oil and gas production as well as exports to euro-area partners.