Amfi India Report

amfi india report wallpaperAMFI provides useful knowledge and insights regarding mutual funds and investments. The half-yearly review of Amfi classification as mandated by the market regulator Sebi is falling due and mutual fund industry body Association of Mutual Funds in India Amfi is expected to release a revised list of largecaps midcaps and smallcaps by the first week of January 2021.

Https Www Amfiindia Com Themes Theme1 Images Gallery Pdf Amfi Crisil Mutual Fund Factbook Pdf

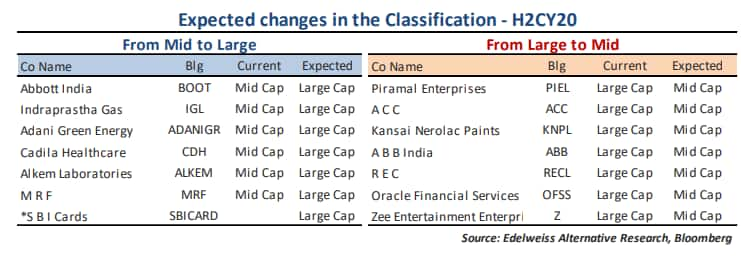

The report adds that Bank of Baroda General Insurance Corporation of India Concor India United Breweries MRF and NMDC will be moved lower to the mid-cap segment from the current large-cap.

Amfi india report. The outflow in November was the highest since at least April 2018 when AMFI started compiling data in the current format. It has asked the finance minister to bring tax parity between MF schemes and unit-linked insurance plans ULIPs in the forthcoming Budget. The new categorisation will be in force till July 2021.

The category registered an outflow of Rs 141 lakh crore as against an inflow of Rs 79000 crore in August data from Association of Mutual Funds in India AMFI shows. Association of Mutual Funds in India AMFIs Operations Committee has revised the process to be followed for generating AUM by geography report for registrar and transfer agents RTAs and fund houses. Selling pressure on equity mutual fund schemes eased in January 2021.

IFA REPORT FROM AMFI BCG UNLOCKING THE 100 TRILLION OPPORTUNITY is a vision report published by AMFI in consultation with BCG. Annual Report - 2015 - 16 Inaugural session in Eastern India Micro Finance Summit 2016 A landmark of sharing of thought and ideas for effective partnership between Micro Finance Industry Bank Financial Institution and other stakeholders 2nd AMFI-WB Banking Summit 2015 A Successful congregation of Financial Institutions. Liquid funds saw record outflows in February at Rs 43825 crore as against inflows of Rs 59682 crore in January data from the Association of Mutual Funds in India AMFI showed.

AMFI is a nodal association of mutual funds across India. Redemption from equity mutual funds was Rs 9253 crore in January compared to Rs 10147 crore in December 2020 as per data. Click on the logo to go to respective AMCs Website Scheme-wise Annual Report.

December 2020 cut off for large-cap stocks was up 83 per cent to Rs 28897 crore and for midcap its was up 21 per cent at Rs 8389 crore as compared to June 2020. From April 1 2018 inflows from beyond B30 cities are eligible for the extra 30 basis incentive instead of top T15 cities earlier. In this article show.

Find the latest 54606 AMFI stock quote history news and other vital information to help you with your stock trading and investing. Read on to find out more on Amfis December report on the mutual funds industry. Browse through the AMFI monthly editions on mutual fund investments in India from April 1999 to today.

AMFI is dedicated to developing the Indian Mutual Fund Industry on professional healthy and ethical lines. Mutual fund industry body Amfi in its Budget proposal has raised the need to bring parity in tax treatment for investments in different financial sector. The association of mutual funds in India released the stock classification list as part of their semi-annual review based on the average market capitalization of stocks.

The paper AMFI BCG report has analyzed past trends and future opportunities for all stakeholders related to the mutual fund industry. Indias mutual fund industry could be worth Rs 100 lakh crore in the next decade as per the AMFI BCG vision statement. The investor base could increase to Rs10 crore from Rs2 crore during the same time.

Amfi India Mumbai Maharashtra. Indias ranking among global mutual funds has improved to 17 in 2019 from 22 in 2008. In terms of average net assets under management AUM both open-ended equity and debt schemes improved from November.

According to the Association of Mutual Funds of India Amfi the mutual fund industry AUMs are at an all-time high. The first 10 months of the financial year saw a net outflow of Rs 3054658 crore compared with a net inflow of Rs 8378769 crore in the entire year to March 2020.