Post 911 Gi Bill And 529 Plans

billIf the Post-911 GI Bill benefits are split among multiple dependents and cant pay all the costs for each one then a 529 plan can help cover the remaining qualified higher education expenses associated with attending a college or vocational school. Like most of you we hope to seamlessly combine our 529s with our Coverdell Educational Savings Accounts ESA our Post 911 GI Bill benefit scholarships and education tax credits.

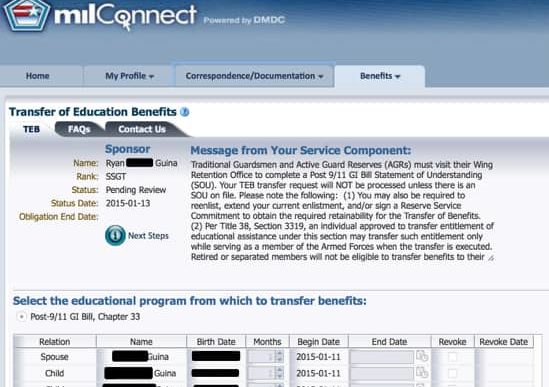

Transfer Your Post 9 11 Gi Bill Transfer Changes Coming

Transfer Your Post 9 11 Gi Bill Transfer Changes Coming

Phase I The Post 911 GI.

Post 911 gi bill and 529 plans. Questions and Answers about 529 Plans Many military families have been about to take advantage of the Post 911 GI Bill benefit which allows certain service members to transfer GI Bill benefits to their spouse andor children. Supplies and equipment required for enrollment or. Post 911 GI Bill January 13 2014 by My6Ms.

With more parents contributing to a 529 plan to help pay for their childs college expenses I get asked about them a lot. 529s get taxed and penalized on gains if not used for qualified college expenses. The Power of the Post-911 GI Bill.

A 529 plan can supplement these service-earned education benefits. Anyone know why he owes this tax. The Post 911 GI Bill covers the full cost of in-state tuition and fees at public colleges for up to 36 months four academic years or up to 18077 per year for private colleges and foreign.

Can I withdraw non-qualified distributions from a 529 plan up to the amount that my post-911 GI bill is paying for my kids college without incurring the 10 additional tax. Thats the one type of VA program that isnt classified as a scholarship under the 529 rules. I understand that the earnings Box 2 of the 1099-Q from that distribution are taxable.

If you have both in place you have the possibility to pay for your childrens college at a reduced price and potentially with tax advantaged funds. Some of you may have also set up a 529 Plan to help pay for their college education. Rowe Price right after each child was born.

Some of you may have decided to use your post 911 GI Bill for your childrens education. Proceeds from a 529 Plan can be used for assuming the GI Bill paid for tuition and fees. Outside of the GI Bill Tania and I established College 529 plans through T.

So if you use the 911 GIB and it covers the full cost of attendance then unless you can transfer the 329 to another eligible beneficiary when you withdrawal it from the 529 youre stuck with the taxes and penalty. The combination of the GI Bill and 529 Plans gets even more complicated. Since each child represents a 1000 child tax credit each year weve taken 3000 right off the top of each years tax return and sock 1000 away directly into each childs 529 plan.

Any education benefits you receive under the Post-911 GI Bill will make you eligible for the scholarship exception. Eligible expenses range from tuition. A 529 plan can supplement this federal education aid.

The GI Bill can be used to pay for Tuition and Fees and the 529 plan can be used for other expenses. In a way that you wouldnt be if they had gotten a full ride scholarship instead. The Power of the Post-911 GI Bill.

GI Bill and 529 Plans. 529 plans do not have the same income and contribution limits as the ESA and are often more attractive to higher income earners. For some strange reason.

529 College Plans offer a range of investment options. 529 GI Bill Scholarships and the Post 911 GI Bill covered 100 of my daughters school costs in Fall 2020. More to follow on the strategy but I just wanted to verify this exception to the additional 10 penalty.

The Post 911 GI Bill specifies that for financial aid purposes VA benefits should not be considered as a resource either as income or a scholarship to the recipient when need is calculated. Every penny from the 529 Plan and the post-911 GI Bill was used for qualified educational expenses and nearly every penny was paid directly to the college only the book and housing allowance was paid to me which we then paid the school. I have a 529 with her as the beneficiary and made a distribution directly to her account for an amount less than her total costs.

This means you will be able to take withdrawals from your 529 plan up to the amount of GI Bill education benefits received without incurring the usual 10 percent penalty tax on nonqualified withdrawals. Ive been contemplating some different strategies for taxesestate. For more information about the ability to transfer Post 911 GI Bill benefits visit this website.

This gives us the flexibility to combine college savings with the GI Bill to pay for our childrens college. If you split your Post-911 GI Bill benefits among multiple dependents then a 529 plan can help cover the remaining qualified higher education expenses associated with attending a two-year or four-year college apprenticeships trade or vocational school. Some static portfolios can be 100 stock or 100 bond funds or you can choose age-based portfolios that are a mix of stock and bond funds which shift to become more conservative as college time.

A 529 College Savings Plan is built around an investment portfolio designed to grow enough to cover college costs in the years youll need it. Eligible expenses range from tuition. The Post-911 GI Bill provides 36 months of benefits that cover college tuition up to the maximum in-state college tuition rate a Monthly Housing Allowance MHA equivalent to an E-5 with dependents rate and a 1000 annual stipend to help cover the cost of books and supplies.

Computer equipment and related technology and services. Like VA your state of residence may offer tax benefits on contributions you make to their plan. Supplies and equipment required for enrollment or attendance.

If possible Military should leverage the Post 911 GI Bill and focus more on saving for their own retirement rather than the assumption that their children will need it for college or even attend college at all. The Post-911 GI Bill provides 36 months of benefits that cover college tuition up to the maximum in-state college tuition rate a Monthly Housing Allowance MHA equivalent to an E-5 with dependents rate and a 1000 annual stipend to help cover the cost of books and supplies. Computer equipment and related technology and services.

Benefits received under the Post 911 GI Bill are reported on your Form 1098-T as scholarships in box 5. It appears the answer is yes. Qualified expenses for 529 plans are much broader than for deductions and credits.

Coordinating the GI Bill with 529 Plans.

50 50 Profile University Of Mary Washington Summer Science Mary Washington College Rankings

50 50 Profile University Of Mary Washington Summer Science Mary Washington College Rankings

6 Ways To Use Your Post 9 11 Gi Bill Straighterline

6 Ways To Use Your Post 9 11 Gi Bill Straighterline

2020 Post 9 11 Gi Bill Overview Payment Rates Eligibility Allowances

2020 Post 9 11 Gi Bill Overview Payment Rates Eligibility Allowances

Gi Bill Covers Higher Education Costs For Veterans

Gi Bill Covers Higher Education Costs For Veterans

Search For The Best Online Military Friendly Schools 2018 Online Education Master Degree Programs Best Online Colleges

Search For The Best Online Military Friendly Schools 2018 Online Education Master Degree Programs Best Online Colleges

Today S Military Branches Know The Value Of Education And As A Result Have Taken Steps To Assist With Getting Online College Values Education College Resources

Today S Military Branches Know The Value Of Education And As A Result Have Taken Steps To Assist With Getting Online College Values Education College Resources

How To Take Advantage Of The Gi Bill For A College Education Student Loan Hero

How To Take Advantage Of The Gi Bill For A College Education Student Loan Hero

History Of The Gi Bill Military Benefits

History Of The Gi Bill Military Benefits

Financial Aid For Veterans Dependents Accredited Schools Online Find Top Rated Accredited Programs Online Financial Aid Scholarships Scholarships For College

Financial Aid For Veterans Dependents Accredited Schools Online Find Top Rated Accredited Programs Online Financial Aid Scholarships Scholarships For College

A Gi Bill Is A Terrible Thing To Waste Military Guide

A Gi Bill Is A Terrible Thing To Waste Military Guide

Https Www Tamiu Edu Veterans Transfer 911 Shtml

Use Gi Bill Benefits To Pay For Children S College Education

Use Gi Bill Benefits To Pay For Children S College Education

The Secret To Getting Two Degrees Or More With The Gi Bill

The Secret To Getting Two Degrees Or More With The Gi Bill

Gi Bill Snafus Still Keeping Veterans From Tapping Benefits To Pay For Their Kids College

Post 9 11 Gi Bill Benefits Right Now Are The Most Generous In The History Of The Gi Bill But In Some Cases It Does N Gi Bill Online College College Resources

Post 9 11 Gi Bill Benefits Right Now Are The Most Generous In The History Of The Gi Bill But In Some Cases It Does N Gi Bill Online College College Resources

Is Jrotc Right For Me Accredited Schools Online Find Top Rated Accredited Programs Online College Fun Online Student Admissions Interview

Is Jrotc Right For Me Accredited Schools Online Find Top Rated Accredited Programs Online College Fun Online Student Admissions Interview

Financial Aid For Online Students Accredited Schools Online Financial Aid Online Education Courses Online Student

Financial Aid For Online Students Accredited Schools Online Financial Aid Online Education Courses Online Student

After Service Trade School Veterans Accredited Schools Online Find Top Rated Accredited Programs Online Trade School Online School Vocational School

After Service Trade School Veterans Accredited Schools Online Find Top Rated Accredited Programs Online Trade School Online School Vocational School