Is Post 9/11 Gi Bill Taxable

bill post taxableJust like VA health benefits education benefits are connected to your service and not reported to the IRS. You may qualify if you served on active duty after September 10 2001 or if youre the qualified spouse or dependent child of a Veteran who meets these service requirements.

Arms May Be The Right Choice For You Adjustable Rate Mortgage Money Saving Tips Home Mortgage

Arms May Be The Right Choice For You Adjustable Rate Mortgage Money Saving Tips Home Mortgage

You have returned to college and are receiving two education benefits under the latest GI Bill.

Is post 9/11 gi bill taxable. Military Education Information FAQs come directly from the Veterans Administration GI Bill web site. Post 911 GI Bill Military Education Benefits and Veteran Education Benefits are timely and important to you. You dont have to report these benefits as income on your tax return.

10 2001 and are still on active duty or if you are an honorably discharged Veteran or were discharged with a service-connected disability after 30 days you may be eligible for this VA-administered program. The Forever GI Bill Montgomery GI Bill and Post-911 GI Bill have many benefits and one of them is that in most circumstances the benefits are not taxable. 4000 paid directly to your college for tuition.

The short answer is no these benefits are NOT taxable and should NOT be reported on your tax return as income. Post 911 GI Gill Eligibility for Active Duty Veterans Veterans who have served at least 90 days of active duty service after September 10 2001 and received an honorable discharge will qualify for the Post-911 GI Bill. Neither of these benefits is taxable and you do not report them on your tax return.

For SSDI Ive read it can and cant be taxed depends on gross combined income if married. All versions of the GI Bill including the Post-911 GI Bill and the Montgomery GI Bill provide tax-free benefits for higher education including undergraduate and postgraduate study as well as vocational training. Sort of in the same topic I had a thought if one uses the Post 911 Gi Bill is the BAH entitlement taxable.

Handouts and Forms - Education and Training Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. A 1612 monthly basic housing allowance BHA that is directly deposited to your checking account and. Are my Post 911 GI Bill Benefits taxable.

The benefits can add up to thousands of nontaxable dollars that you do not have to report as income on your individual income tax return Form 1040. Find out if you can get help paying for school or job training through the Post-911 GI Bill Chapter 33. To qualify for the full benefit a veteran must have served at least 3 years of active duty after September 10 2001.

Neither of these benefits is taxable and you do not report them on your tax return. You may wonder if you have to report your GI Bill benefits as income on your taxes well the good news is that the answer is NO. 1098-T with FAFSA and Post 911 GI Bill.

In 2017 according to CBS News approximately 40 percent of all GI Bill funds were distributed to for-profit colleges. There is a link under box 1 that says. Other scholarships could be if not used for tuition.

No the refund would not be from the VA portion. GI Bill benefits are NOT taxable and should NOT be reported on your. The original Post-911 GI Bills provisions went into effect on August 1 2009.

If the 1098-T doesnt have the right numbers on it the program wont make the right calculation. You have returned to college and are receiving two education benefits under the latest GI Bill. If you also received a scholarship and you also received a refund that refund would be taxed.

VA funds are never taxable. 1 a 1534 monthly basic housing allowance BAH that is directly deposited to your. The GI Bill provides education benefits to veterans and their dependents.

Was reading your posts in regards to SSDI and had a few questions if you dont mind. If you have at least 90 days of aggregate active duty service after Sept. You have returned to college and are receiving two education benefits under the latest GI Bill.

If youre a service member or a veteran with an honorable discharge the GI Bill may provide funding to help with college costs. Neither of these benefits is taxable and you do not report them on your tax return. 1 a 1534 monthly basic housing allowance BAH that is directly deposited to your checking account and 2 3840 paid directly to your college for tuition.

A 1534 monthly basic housing allowance BAH that is directly deposited to your checking account and 3840 paid directly to your college for tuition. You have returned to college and are receiving two education benefits under the latest GI Bill. Any assistance from the VA needs to be applied to tuition and fees.

Or is it an entitlement. The Post-911 Veterans Educational Assistance Act of 2008 improves educational benefits for certain individuals serving on active duty in. Use the students school account statement and adjust the entries if needed.

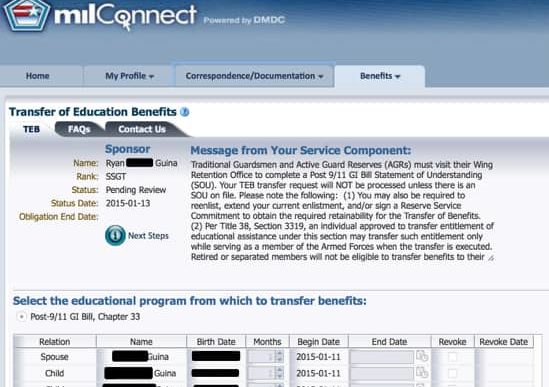

Transfer Your Post 9 11 Gi Bill Transfer Changes Coming

Transfer Your Post 9 11 Gi Bill Transfer Changes Coming

Post 9 11 Gi Bill Transfer Benefits To Spouse Or Dependents Military Benefits

Post 9 11 Gi Bill Transfer Benefits To Spouse Or Dependents Military Benefits

Earn The Army Badge For Fitness And Win Incentives Army Badge Military Education United States Army

Earn The Army Badge For Fitness And Win Incentives Army Badge Military Education United States Army

Gi Bill Unknown Benefits Training Licenses More Military Benefits

Gi Bill Unknown Benefits Training Licenses More Military Benefits

Gi Bill Finally Approved After Successfully Upgrading My Discharge From General Uhc To Honorable I Ll Answer Any Questions In The Comments Veterans

Gi Bill Finally Approved After Successfully Upgrading My Discharge From General Uhc To Honorable I Ll Answer Any Questions In The Comments Veterans

What You Need To Know About Gi Bill Benefits And Tax Deductions Columbia Southern University

What You Need To Know About Gi Bill Benefits And Tax Deductions Columbia Southern University

2020 Post 9 11 Gi Bill Overview Payment Rates Eligibility Allowances

2020 Post 9 11 Gi Bill Overview Payment Rates Eligibility Allowances

Post 9 11 Gi Bill Overview Military Benefits

Post 9 11 Gi Bill Overview Military Benefits

The Post 9 11 Gi Bill Explained Video Cck Law

The Post 9 11 Gi Bill Explained Video Cck Law

Post 9 11 Gi Bill Benefits In A Divorce Military Divorce Guide

Post 9 11 Gi Bill Benefits In A Divorce Military Divorce Guide

History Of The Gi Bill Military Benefits

History Of The Gi Bill Military Benefits

Gi Bill 2020 2021 Payment Rates Military Benefits

Gi Bill 2020 2021 Payment Rates Military Benefits

Soldier S Story Her Pursuit For A Degree Military Benefits

Soldier S Story Her Pursuit For A Degree Military Benefits

Simplify Filing This Year With Miltax The 100 Free Service From The Department Of Defense For Service Members And Thei Tax Extension Tax Preparation Tax Prep

Simplify Filing This Year With Miltax The 100 Free Service From The Department Of Defense For Service Members And Thei Tax Extension Tax Preparation Tax Prep

Are Gi Bill Payments Taxable Military Com

Are Gi Bill Payments Taxable Military Com

Post 9 11 Gi Bill Bah Rate Aka Mha For Online Colleges Military Benefits

Post 9 11 Gi Bill Bah Rate Aka Mha For Online Colleges Military Benefits

Finally A Retirement Calculator That Might Help You Retire Retirement Calculator Investing Retirement

Finally A Retirement Calculator That Might Help You Retire Retirement Calculator Investing Retirement

New Gi Bill Doubles Education Dollars For Post 9 11 Veterans Gi Bill Education Veteran

New Gi Bill Doubles Education Dollars For Post 9 11 Veterans Gi Bill Education Veteran

Are My Post 911 Gi Bill Benefits Taxable Military Benefits

Are My Post 911 Gi Bill Benefits Taxable Military Benefits