Imf Loan Policy On Developing Economy

policy wallpaperThis Economic Relief Package i extends the deferment on principal payments of financing or loan to all sectors ii provides for the restructuring or deferment on principal repayment of personal loans and hire purchase such as car financing for a period not exceeding 10 years iii provides for the deferment on principal repayments of property financing iv provides for the conversion of any outstanding credit card balances into term loans not exceeding 3 years for affected. It was an adjustment agency providing advice on balance of payments policy a financing agency providing short-term liquidity to countries encountering balance of payments problems and finally an agent for managing the Bretton Woods international monetary system which was based on an adjustable.

Ten Easy Ways To Facilitate Imf Global Growth Forecast Imf Global Growth Forecast Https Macro Economic Com Ten Easy Developed Economy Global Economy Global

Ten Easy Ways To Facilitate Imf Global Growth Forecast Imf Global Growth Forecast Https Macro Economic Com Ten Easy Developed Economy Global Economy Global

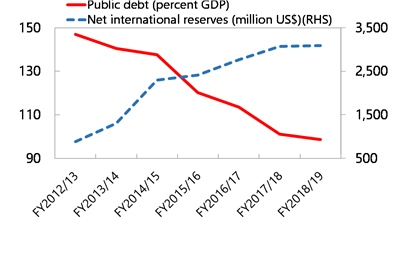

The primary purpose of taking loans from the IMF is that Pakistans Government wants to stabilize its deteriorating economy exchange rates and balance of payments however this relief is short-term and usually yields a new crisis in long-term as the debt matures and the government gets into a IN LONG.

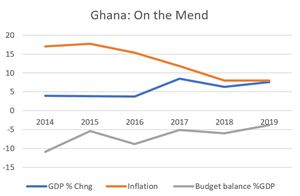

Imf loan policy on developing economy. The demand for stand-by and extended arrangements with the Fund rose. Is the western countries using the IMF as an instrument for controlling the economy of the developing nations. In March Ecuador signed an agreement to borrow 42bn from the IMF over three years provided that the government would adhere to a certain economic program spelled out in the arrangement.

Capital market in nigerians economic development. To know if the westen countries are using the IMF as an instrument for controlling the economy of the developing nation. An appraisal of pay-as you earn system of taxation in nigeria.

In the worldwide economic and debt crisis of the eighties the International Monetary Fund increasingly became the lender of last resort for a great many Third World countries. IMF Loan Policy as a technique of economic management to bring about Sustainable economic growth and development has been the pursuit of nations and formal articulation of how money affects economic aggregates dates back the time of Adams Smith and later championed by the government. IMF Loan Policy as a technique of economic management to bring about Sustainable economic growth and development has been the pursuit of nations and formal articulation of how money affects economic aggregates dates back the time of Adams Smith and later championed by the government.

Fills Deficit Gaps If a country has a balance of payments deficit. Implication of accounting as an internal control mechanism in the government ministries. These policy adjustments are conditions for IMF loans and serve to ensure that the country will be able to repay the IMF.

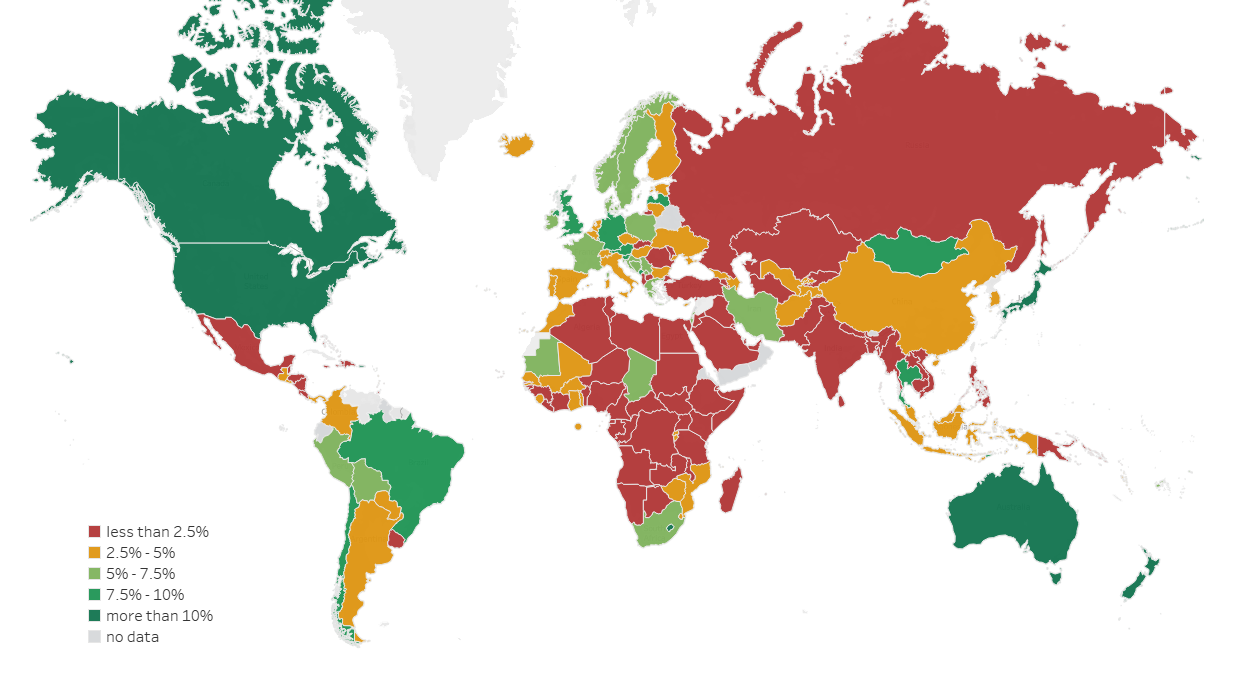

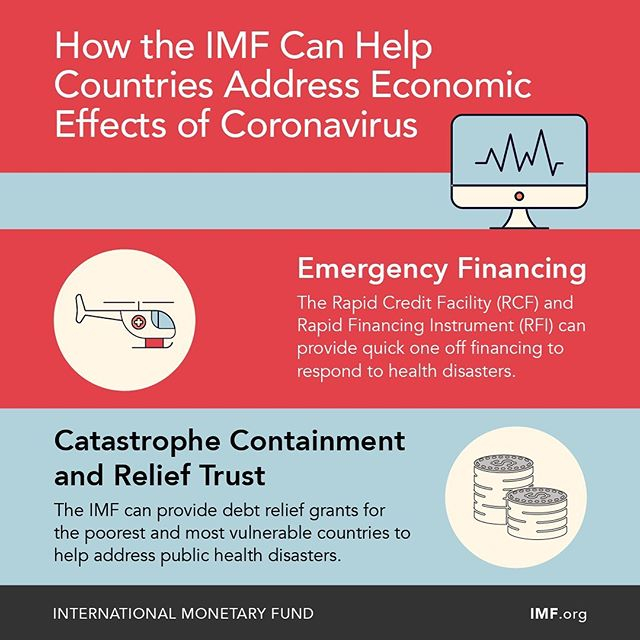

To know the implementation of IMF loan policy always goes with adverse effect on the economy of the developing nations or countries with special reference to Nigeria. This page provides an overview of assistance approved by the IMFs Executive Board since late March 2020 under its various lending facilities and debt service relief financed by the Catastrophe Containment and Relief Trust CCRT. The IMF can attach conditions to these loans including prescribed economic policies to which borrowing governments must comply.

The IMF is often depicted as a heartless moneylender which forces poor countries to adopt bad policies and takes its pound of flesh back while the countries sink further into poverty. It now insists on the supply side policy as a condition for assistance in addition to loans meant for short-term BOP difficulties. To keep the balance of payments in check and to meet the financial obligations government of Pakistan unfortunately always resort to take loans hence the government has now resorted to IMF.

An evaluation of the international monetary fund imt loan policy on developing economy. March 30 2020 When a country borrows from the IMF its government agrees to adjust its economic policies to overcome the problems that led it to seek financial aid. Why do the implementation of the IMF loan policy always goes with adverse effect on the economy of the developing nations or countries with special reference to Nigeria.

IMF Loan Policy as a technique of economic management to bring about Sustainable economic growth and development has been the pursuit of nations and formal articulation of how money affects economic aggregates dates back the time of Adams Smith and later championed by the government. The IMFs lending toolkit is continuously refined to meet countries changing needs. The Trade Integration Mechanism allows the IMF to provide loans under one of its facilities to a developing country whose balance of payments is suffering because of multilateral trade liberalization either because its export earnings decline when it loses preferential access to certain markets or because prices for food imports go up when agricultural subsidies are eliminated.

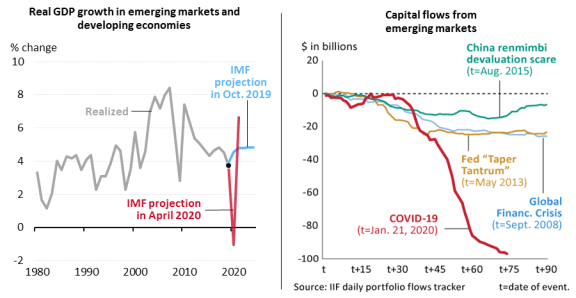

As originally envisaged the International Monetary Fund IMF had three functions. The IMFs impact in developing countries IMF loans are usually short term given when countries are in distress thus ill-equipped to afford belt-tightening. The IMF is providing financial assistance and debt service relief to member countries facing the economic impact of the COVID-19 pandemic.

With world trade weak and interest rates high a considerable number of developing countries got into serious balance-of-payments difficulties. What emerges from the structural adjustment facility is that the IMFs loan is now available to member countries in support of policy programmes. He IMF assists countries hit by crises by providing them financial support to create breathing room as they implement adjustment policies to restore economic stability and growth.

V Poverty Reduction and Growth Facility PRGF. Problems of obtaining bank loans in nigerian banks. It also provides precautionary financing to help prevent and insure against crises.

Is Duty Free Facility Enough To Boost Export To China Business Pages Developing Country Economic Activity

Is Duty Free Facility Enough To Boost Export To China Business Pages Developing Country Economic Activity

Lending International Monetary Fund Annual Report 2019 Our Connected World

Lending International Monetary Fund Annual Report 2019 Our Connected World

32 Evolution Of The International Eco Sys Teaching Economics Economics Lessons Economics Notes

32 Evolution Of The International Eco Sys Teaching Economics Economics Lessons Economics Notes

Imf Videos Transforming Economies To Benefit The Poor The Complementary Roles Of The Public And Private Sectors For Inclusiv Private Sector Inclusive Growth

Imf Videos Transforming Economies To Benefit The Poor The Complementary Roles Of The Public And Private Sectors For Inclusiv Private Sector Inclusive Growth

Https Www Jstor Org Stable 2704033

8 Signs Youre In Love With Endogenous Growth Theory Endogenous Growth Theory Https Macro Economic Com 8 S Signs Youre In Love 8th Sign Economic Development

8 Signs Youre In Love With Endogenous Growth Theory Endogenous Growth Theory Https Macro Economic Com 8 S Signs Youre In Love 8th Sign Economic Development

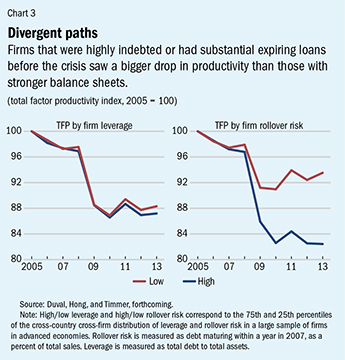

Stuck In A Rut Finance Development March 2017

Stuck In A Rut Finance Development March 2017

Https Www Du Edu Korbel Hrhw Researchdigest Africa Imfandworldbank Pdf

Difference Between Imf And World Bank In 2020 Economic Development Financial Institutions Developed Nation

Difference Between Imf And World Bank In 2020 Economic Development Financial Institutions Developed Nation

Covid 19 Role Of The International Financial Institutions Everycrsreport Com

Covid 19 Role Of The International Financial Institutions Everycrsreport Com

Imf Annual Report 2020 What We Do Lending

Imf Annual Report 2020 What We Do Lending

Imf Fears Trade War And Weak Europe Could Trigger Sharp Global Slowdown Free Online Courses Global Economy Fund

Imf Fears Trade War And Weak Europe Could Trigger Sharp Global Slowdown Free Online Courses Global Economy Fund

Trade In Services In The Global Economy Balance Of Payment Data Shows Service Exports Of 23 Of Global Exports And Wto Oecd Sho Global Economy Trading Service

Trade In Services In The Global Economy Balance Of Payment Data Shows Service Exports Of 23 Of Global Exports And Wto Oecd Sho Global Economy Trading Service

Strengthening The International Monetary Fund For Stability And Sustainable Development G20 Insights

Strengthening The International Monetary Fund For Stability And Sustainable Development G20 Insights